World - Apple Juice - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingApple Juice Market - China Dominates in Global Apple Juice Production and Trade

From 2007-2012, global production of single-strength-equivalent apple juice showed a steady decline, with a CAGR of -X%. In 2013, however, production in physical terms on the global apple juice market had an estimated increase by X%, reaching X million tons, which is far below the highest level of production of single-strength-equivalent apple juice recorded in 2007 (X million tons).

The country with the largest apple production in 2013 were China (X million tons), which accounted for X% of total output. It was distantly followed by the USA with X million tons. U.S. production declined by X% annually from 2007-2013, while China displayed healthy growth by X% annually. Upward trends were observed in the volume of harvested areas for apples. There was a gradual increase up to X thousand HA from 2007-2013, representing a compound annual growth rate (CAGR) of X%.

The yield of apples fluctuated significantly in the analyzed period. Its lowest point was in 2007 at X X Hg/Ha and the highest was in 2013 with X X Hg/Ha. The variance in yields can be explained mainly by the different climatic conditions.

The output of the seven major producers of single-strength-equivalent apple juice, namely China (X thousand tons), Poland (X thousand tons), Turkey (X thousand tons), the USA (X thousand tons), Argentina (X thousand tons), Chile (X thousand tons), Hungary (X thousand tonnes) and Brazil, represent more than three-fours of global output.

In 2013, the USA, Germany, the UK, the Russian Federation, Japan and the Netherlands were the main destinations of apple juice imports and together made up roughly X% of total imports. In physical terms, X% of exports came from China, Poland, Germany, Ukraine and Austria.

China dominates in global apple juice production and trade. In 2011, China exported X% of its total apple juice output. Of this amount, X% was supplied to the United States, where Chinese apple juice held X% share of total U.S. consumption.

In China, only a small percentage of apples are grown specifically for juice processing. The juice industry uses apples that are small, misshapen, or off-color to sell on the fresh market. On average, about X% of apples are below fresh-market standards.

In the last few years, the supply of apples in China as the main raw material for juice has fallen. As a result, juice processors sometimes bid against each other to purchase apples. They also have to compete with the growing domestic demand for fresh fruits, which resulted in upward pressure on fresh apple prices. Moreover, apple-processing companies find it difficult to procure the high-acid apple varieties demanded by juice buyers. The market for higher priced fresh fruit attracts the best quality apples and farmers prefer to plant sweeter varieties favored by the fresh market. As robust demand seems to have caught up with the apple supply, China's limited supply of this raw material may act as a restraint on the apple juice industry's growth in the country.

One of the main global trends in the apple juice industry in the last few years has been a shifting of potential market opportunities from developed countries to developing ones. While the economically mature markets of the USA, Canada, Australia and Western Europe are close to their saturation point in terms of apple juice consumption, emerging economies, such as China, India, Russia, Brazil, Eastern European and South American countries are far from saturated. They share a few similar characteristics, including rising population, an improved economic situation, rising disposable incomes and urbanization.

The food processing industry has always been heavily reliant on international trade to source its main raw materials. Large food companies try to reduce the volatility in raw material prices. One of the main ways to do this is by establishing long-term pricing agreements and backward integration (contractual farming). These factors will strongly influence the market in the medium term.

Apple juice manufacturers have to find a delicate balance between managing increasing overhead costs, due to commodity and logistical price increases, and growing retail price increases. A popular retail strategy includes promotional price activity for brands, thus narrowing the gap with private label and B-brand alternatives.

Do you want to know more about the global apple juice market? Get the latest trends and insight from our report. It includes a wide range of statistics on

- apple juice market share

- apple juice prices

- apple juice industry

- apple juice sales

- apple juice market forecast

- apple juice price forecast

- key apple juice producers

This report provides an in-depth analysis of the global apple juice market. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- FCL 518 - Apple Juice

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

Data coverage:

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

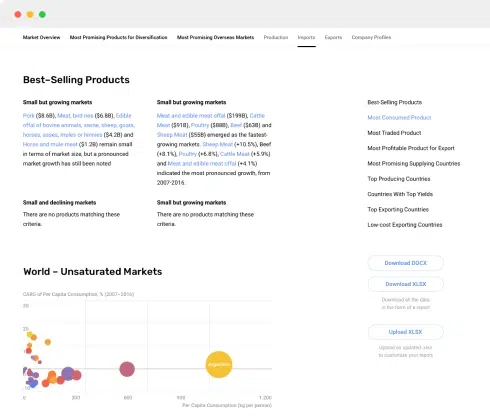

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

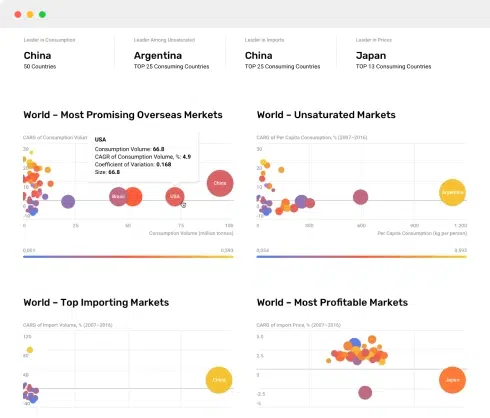

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

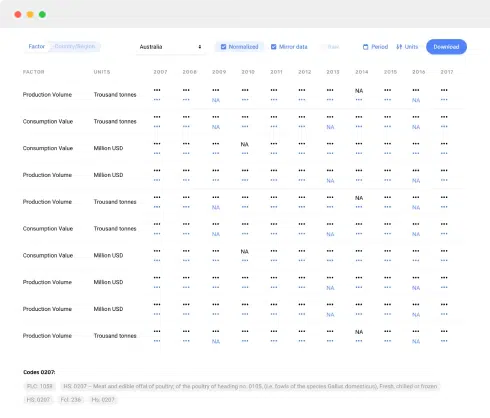

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023