U.S. Fluid Milk Market. Analysis And Forecast to 2030

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingFluid Milk Market - U.S. Milk Industry Aims to Win Back the Consumer by Investing in Milk-Based Products

Lately, milk has been facing a fierce competition from alternative products, such as smoothies and RTD tea. This trend was mostly demonstrated by young consumers who prefer customizing their drinks. Negative dynamics in U.S. milk consumption will also be influenced by the ageing of population in the country, as children have been traditionally among the major consumers of milk. Unlike younger consumers, older population tends to abstain from milk, due to stomach problems that may be triggered by lactose. What's more, the introduction of juices and other beverages fortified with calcium, as well as non-dairy almond milk and coconut milk may also restrain milk consumption.

Against the backdrop of a sluggish demand for milk among the Americans, buildup of consuming industries, such as production of cheese, butter, ice-cream, yoghurt and others, will be the growth driver for fluid milk production.

Between 2008 and 2014, the U.S. fluid milk market showed positive dynamics. It rose from X billion pounds in 2008 to X billion pounds in 2014, expanding with a CAGR of +X%.

Thailand was the main supplier of fluid milk into the U.S., with a X% share of total U.S. imports in 2014. It was followed by Mexico (X%) and the Republic of Korea (X%). However, the fastest growing suppliers were Brazil (+X% per year) and the Philippines (+X% per year) from 2007 to 2014. Thailand (+X percentage points) significantly strengthened its position in the U.S. import structure. By contrast, Mexico (-X percentage points) saw its share reduced.

In 2014, the main destinations of U.S. fluid milk exports were Canada (X%) and distantly Mexico (X%). The share exported to Canada (+X percentage points) and China (+X percentage points) increased, while the share sent to Mexico (-X percentage points) and Japan (-X percentage points) illustrated negative dynamics. The shares of the other countries remained relatively stable throughout the analyzed period.

Do you want to know more about the U.S. fluid milk market? Get the latest trends and insight from our report. It includes a wide range of statistics on

- fluid milk market share

- fluid milk prices

- fluid milk industry

- fluid milk sales

- fluid milk market forecast

- fluid milk price forecast

- key fluid milk producers

This report provides an in-depth analysis of the fluid milk market in the U.S.. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- NAICS 311511 - Fluid milk manufacturing

Companies mentioned:

- Dean Foods Company

- Whitewave Foods Company

- The Dannon Company

- HP Hood

- Turkey Hill

- Prairie Farms Dairy

- Hiland Dairy Foods Company.

- California Dairies

- Byrne Dairy

- Agri-Mark

- United Dairy

- Chobani

- Upstate Niagara Cooperative

- Plains Dairy

- United Dairymen of Arizona

- Suiza Dairy Corporation

- Borden Dairy Company

- Stremicks Heritage Foods

- Mayfield Dairy Farms

- Purity Dairies

- Southern Foods Group

- Garelick Farms

- Country Fresh

- Land-O-Sun Dairies

- Northwest Dairy Association

- SFG Management Limited Liability Company

- Wwf Operating Company

- Crowley Foods

- Readington Farms

Country coverage:

- United States

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Trade (exports and imports) in the U.S.

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- MARKET STRUCTURE

- TRADE BALANCE

- PER CAPITA CONSUMPTION

- MARKET FORECAST TO 2030

-

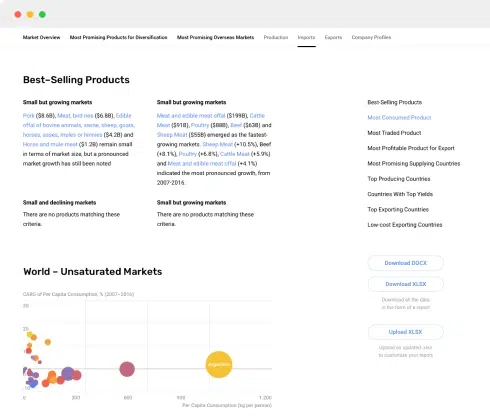

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

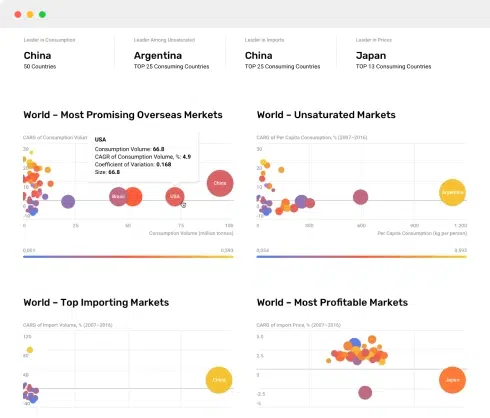

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

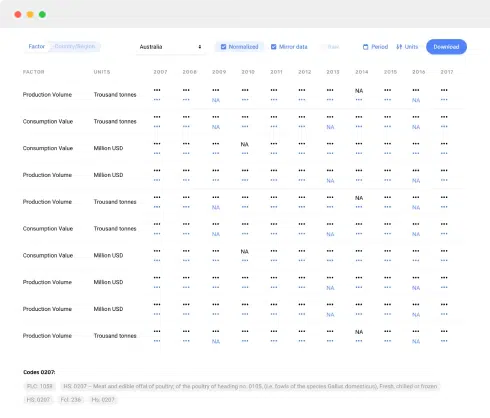

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

8. IMPORTS

The Largest Import Supplying Countries

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Destinations for Exports

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption In 2012-2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Market Structure – Domestic Supply vs. Imports, In Physical Terms, 2012-2023

- Market Structure – Domestic Supply vs. Imports, In Value Terms, 2012-2023

- Trade Balance, In Physical Terms, 2012-2023

- Trade Balance, In Value Terms, 2012-2023

- Per Capita Consumption, 2012-2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023