World - Cement - Market Analysis, Forecast, Size, Trends And Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingCement Industry Outlook 2022-2030

The cement industry is forecast to grow at a compound annual growth rate (CAGR) of 3.4% during the 2022-2030 period, driven by increasing construction activity and rapid urbanization in developing countries. The Asia-Pacific region is expected to remain the largest market for cement, accounting for more than 60% of global demand. China, India, Indonesia, and Vietnam are among the leading producers of cement in the world, with a combined market share of over 50%.

The current state of the cement industry

The cement industry is in a state of flux at the moment. A number of factors are causing changes in the industry, and it is difficult to predict what the future holds.

The first factor affecting the cement industry is the increasing cost of raw materials. Cement is made from limestone, clay, and other minerals. These minerals are becoming more and more expensive to extract, due to declining reserves and environmental regulations. This is causing the price of cement to increase.

The second factor affecting the cement industry is changes in demand. The construction industry, which is the biggest user of cement, has been in decline in recent years. This has caused a decrease in demand for cement, and many cement plants have had to reduce production or even close down.

The third factor affecting the cement industry is new technology. A number of start-ups are working on new ways to make cement that are more environmentally friendly and use less energy. If these technologies become commercially viable, they could disrupt the existing cement industry.

Overall, the future of the cement industry is uncertain. It faces a number of challenges, but new technologies could also provide opportunities for growth.

The outlook for the cement industry in 2022

The growth in the construction sector is being supported by factors such as the increasing urbanization and industrialization rates, as well as the growing population. All these factors are resulting in an increased demand for housing and commercial spaces, which in turn is driving the growth of the construction sector.

The cement industry is in a state of transition. The traditional business model, based on the production of Portland cement, is being challenged by new technologies and changing customer preferences.

The use of Portland cement has been declining in developed countries for many years. This is due to the increased use of alternative materials, such as concrete and composite materials. In addition, the use of Portland cement is being replaced by other types of cement, such as fly ash or slag cement.

The traditional business model for the cement industry has been based on the production of clinker, the main ingredient of Portland cement. However, this model is under pressure from two sides. First, new technologies are emerging that can produce cement without the need for clinker. Second, changing customer preferences are leading to increased demand for alternative types of cement.

The future of the cement industry therefore depends on its ability to adapt to these changes. The industry must invest in new technologies and develop new types of cement that meet the needs of customers. Only then will it be able to remain successful in the long term.

The factors affecting the outlook for the cement industry

There are several factors that affect the outlook for the cement industry. One of the most important factors is the health of the construction industry. The demand for cement is closely linked to the level of construction activity. When the construction industry is strong, demand for cement is usually high. However, when the construction industry slows down, demand for cement typically declines.

Another important factor affecting the outlook for the cement industry is the availability of raw materials. Cement production requires a number of raw materials, including limestone, clay, and gypsum. If these materials become scarce or more expensive, it could put pressure on cement prices and profitability.

Finally, government regulations can also have an impact on the outlook for the cement industry. For example, environmental regulations may require cement companies to invest in new pollution control equipment. This could raise costs and eat into profits.

The challenges facing the cement industry

There are a number of challenges facing the cement industry. The first is the declining demand for cement. This is due to the slowdown in the construction sector. The second challenge is the increasing cost of raw materials. This is due to the rising cost of energy and transportation. The third challenge is the overcapacity in the industry. This means that there is more capacity than there is demand for cement. As a result, many companies are operating at a loss.

The fourth challenge facing the cement industry is the consolidation of the industry. This means that a few large companies are getting bigger and bigger, while many small companies are going out of business. The fifth challenge is environmental regulations. These regulations are becoming more stringent, and they are costly to comply with. The sixth challenge is competition from other materials, such as concrete, that can be used in place of cement.

Despite these challenges, there are still opportunities for growth in the cement industry. The first opportunity is the increasing demand for infrastructure projects in developing countries. The second opportunity is the development of new products, such as eco-friendly cements.

The opportunities for the cement industry

The cement industry is forecast to grow significantly in the next few years. This growth is driven by several factors, including the increasing demand for infrastructure development around the world. As more countries invest in infrastructure projects, the demand for cement will increase.

Another factor that is driving the growth of the cement industry is the increasing popularity of green construction methods. Cement is a key ingredient in many green construction materials, such as concrete and fiber cement boards. As more builders and architects look for ways to reduce their environmental impact, the demand for these green construction materials will increase.

The cement industry is also benefiting from the recovery of the housing market in many countries. As housing starts increase, so does the demand for cement.

Overall, the outlook for the cement industry is very positive. The increasing demand for infrastructure and green construction materials will help drive significant growth in the coming years.

Conclusion

In summary, the cement industry outlook is mixed with near-term challenges weighing on the mind of cement company executives. The rise in energy and transportation costs, along with continued pressures from environmental regulations, are top concerns. Additionally, overcapacity in China has led to increased exports of cement to other countries, further complicating the global market landscape. Despite these challenges, there are also opportunities for growth in the coming years as demand for infrastructure projects increases around the world. Cement companies that are able to adapt and capitalize on these trends will be well-positioned for success in the future.

This report provides an in-depth analysis of the global cement market. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- Prodcom 23511210 - Portland cement

- Prodcom 23511290 - Other hydraulic cements

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

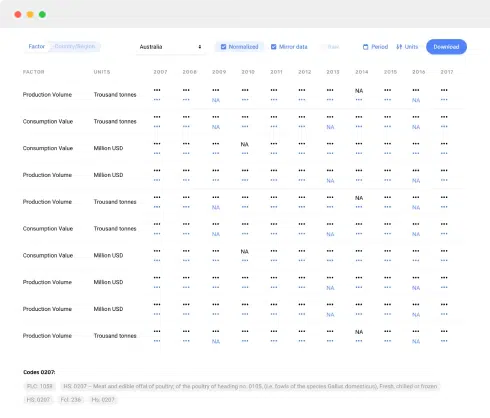

Data coverage:

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Company coverage:

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

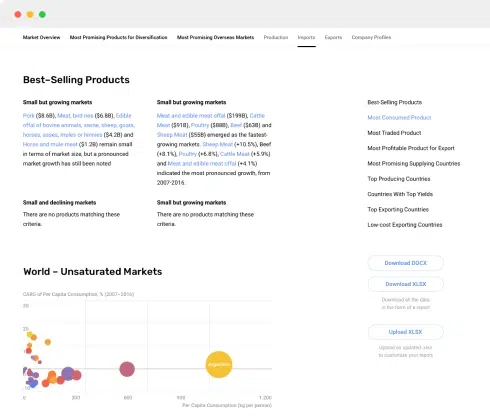

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

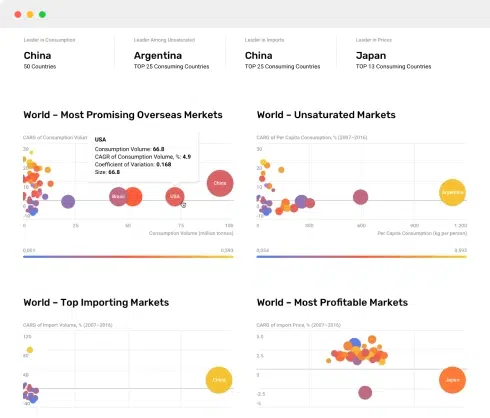

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023