U.S. Doll, Toy, And Game Market. Analysis And Forecast to 2030

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingChina Continues to Dominate the Doll, Toy, and Game Supplies to the U.S.

IndexBox has just published a new report "U.S. Doll, Toy, And Game Market. Analysis And Forecast to 2025". Here is a summary of the report's key findings.

The U.S. Doll, Toy, and Game Market Increased Slightly

In 2017, the U.S. doll, toy, and game market stood at $X in wholesale prices. This figure reflects the total revenue of producers and importers (excluding logistics costs, retail marketing costs, and retailers' margins, which will be included in the final consumer price).

According to IndexBox estimates, from 2008 to 2017 the U.S. doll, toy, and game market showed a negative dynamic, due to a decline in import prices. China continues to buoy the American market with cheap toys against stable domestic demand, thereby determining the overall trend pattern of the market value.

Modest Growth on the U.S. Doll, Toy, and Game Market is Forecasted by 2025

The population growth trend and disposable household income figures constitute the two key factors driving the performance of the U.S. doll and toy market. While the U.S. population continues to grow, a typical aspect of the demographic structure in the USA is that there is now a fall in the proportion of people able to work. This, in turn, exerts a negative impact on the doll and toy market: toys are mainly designed and intended for children; purchases of these products are completed by adults. In addition, the recovery of the U.S. economy and improved employment figures on the labour market are contributing to an increase in disposable household income; these factors, combined with population growth, will promote the increased consumption of dolls and toys in the USA. Therefore, the market is expected to grow by on average +X% in the medium term, which will lead the market to $X by 2025.

Doll and Toy Production Is Set to Remain Significantly below Pre-crisis Indices

U.S. doll, toy, and game manufacturing totaled $X in 2017, falling with a CAGR of -X% from 2008 to 2017. Overall, doll, toy, and game output contracted by X% over the last nine year period. Over the last five years, producer revenue in the doll and toy sector was significantly lower than observed in previous years. Since price competition in this sector remains high, domestic manufacturers were forced to cut prices, to compete against inexpensive imports from developing countries, where salary remuneration appears tangibly lower than on the U.S. labour market.

Nonelectronic Games and Puzzles Occupied X% of Total Production

In 2017, nonelectronic games and puzzles, including parts accounted for X% of U.S doll, toy, and game manufacturing, followed by dolls, action figures, toy animals, and stuffed toys, including parts and accessories (X%), models (operating and static), craft kits and supplies, natural science kits and sets, and collectors' miniatures (X%) and baby carriages and children's vehicles (including parts for children's vehicles sold separately), excluding bicycles with pneumatic tires (X%).

From 2007 to 2017, baby carriages and children's vehicles (including parts for children's vehicles sold separately), excluding bicycles with pneumatic tires (+X%) was the fastest growing product category. By contrast, models (operating and static), craft kits and supplies, natural science kits and sets, and collectors' miniatures (-X%) and nonelectronic games and puzzles, including parts (-X%) illustrated a negative dynamic over the same period. While the share of nonelectronic games and puzzles, including parts (+X percentage points), dolls, action figures, toy animals, and stuffed toys, including parts and accessories (+X percentage points) and baby carriages and children's vehicles (including parts for children's vehicles sold separately), excluding bicycles with pneumatic tires (+X percentage points), increased notably, models (operating and static), craft kits and supplies, natural science kits and sets, and collectors' miniatures reduced its share from X% in 2008 to X% in 2017.

The U.S. Doll, Toy, and Game Market Continues to be Buoyed by Imports

The U.S. doll, toy, and game market is completely dependent on imported products: imports significantly exceed the volume of national production. China controls the Americal toy market, with Mexico, Hong Kong and Canada lagging far behind in terms of total imports.

China Continues to Dominate the Doll, Toy, and Game Supplies to the U.S.

The value of total U.S. doll, toy, and game imports totalled $X in 2017, decreasing at an average annual rate of -X% from 2007-2017. Throughout the period under review, the market remained almost entirely dependent on imports. Since the toy industry is highly labor-intensive, China, with its well-established industry and relatively low labor costs, shall continue to buoy the American market - it is expected that the reliance on imports will continue in the medium term.

China ($X) constitutes a key supplier of dolls, toys, and games into the U.S., with a share of X% of total U.S. imports in 2017. The value of imports from China decreased sharply from 2008-2013 and then seesawed through to 2017, thereby determining an overall trend pattern for total imports. The other importing countries lagged far behind in terms of total imports: Mexico ($X), Hong Kong ($X), Canada ($X) and others.

Most of Doll, Toy, and Game Exports Are Sent to Canada and Mexico

The U.S. exported $X of dolls, toys, and games in 2017, an increase of X% against the previous year. That surge disparaged an eight-year trend of a gradual contraction seen from 2009-2016. In 2017, the main destinations for U.S. doll, toy, and game exports were Canada ($X) and Mexico ($X), together accounting for approx. X% of total exports. Paraguay ($X), Chile ($X) and the UK ($X) also constituted major foreign markets for toy exports from the U.S. From 2007-2017, Paraguay (+X% per year) and Chile (+X% per year) emerged as the fastest growing countries of destination, while exports to Mexico decreased by, on average, -X% per year.

Do you want to know more about the U.S. doll, toy and game market? Get the latest trends and insight from our report. It includes a wide range of statistics on

- doll, toy and game market share

- doll, toy and game prices

- doll, toy and game industry

- doll, toy and game sales

- doll, toy and game import

- doll, toy and game export

- doll, toy and game market forecast

- doll, toy and game price forecast

- key producers of dolls, toys and games

This report provides an in-depth analysis of the market for doll, toy, and game in the U.S.. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- NAICS 339930 - Doll, toy, and game manufacturing

Companies mentioned:

- Mattel

- Hasbro

- Hobby Lobby Stores

- Lego Systems

- Leapfrog Enterprises

- Jakks Pacific

- Wizards of The Coast

- Kids II

- Excelligence Learning Corporation

- Britax Child Safety

- Arrow International

- Evenflo Company

- The Ergo Baby Carrier

- The Vermont Teddy Bear Co Inc

- Gaming Partners International Corporation

- American Plastic Toys

- Delta Education

- Konami Gaming

- Alex Toys

- Cosco

- Plaid Enterprises

- Imperial Toy

- The Little Tikes Company

- Lionel L.L.C.

- Mega Brands America

- Multimedia Games Holding Company

- Progressive Gaming International Corporation

- Shelcore

- Hasbro International

- Dorel U.S.A.

- Toysrus.com

- Cartamundi East Long Meadow

Country coverage:

- United States

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Trade (exports and imports) in the U.S.

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- MARKET STRUCTURE

- TRADE BALANCE

- PER CAPITA CONSUMPTION

- MARKET FORECAST TO 2030

-

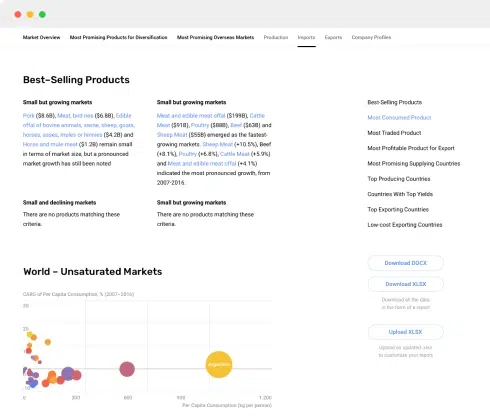

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

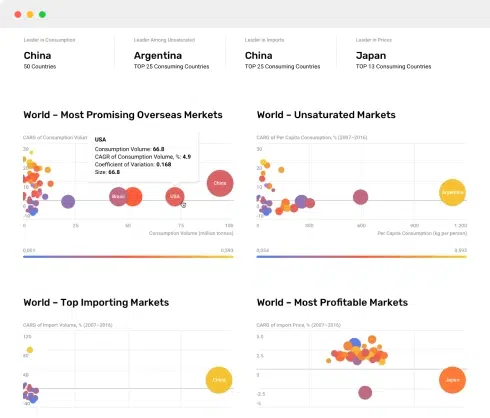

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

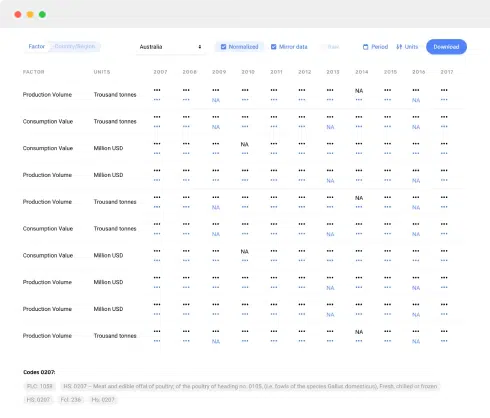

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

8. IMPORTS

The Largest Import Supplying Countries

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Destinations for Exports

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption In 2012-2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Market Structure – Domestic Supply vs. Imports, In Physical Terms, 2012-2023

- Market Structure – Domestic Supply vs. Imports, In Value Terms, 2012-2023

- Trade Balance, In Physical Terms, 2012-2023

- Trade Balance, In Value Terms, 2012-2023

- Per Capita Consumption, 2012-2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023