EU - Paints And Varnishes - Market Analysis, Forecast, Size, Trends And Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingPaint and Varnish Market - EU Paints and Varnishes Deliveries to China and Turkey to Rise, Set Against the Russian Market Shrinking

Photo: © .shock / Bigstockphoto

The European paint and varnish market is largely focused on external exports, which have been declining in the recent years. The reduction in deliveries to Russia, which has long been a key overseas market for EU paints and varnishes, has been the most sensitive area. As a consequence, EU paint and varnish manufacturers have to expand supplies into other foreign markets, with China and Turkey growing the most rapidly.

Total EU exports of paints and varnishes slightly decreased after five years of consistent growth, amounting to X million EUR in 2015. Data on the EU trade with non-EU countries shows that the EU remains a net exporter of paints and varnishes.

Among the EU members, Germany was the main supplier of paints and varnishes, taking a X% share of total exports in 2015. Italy had half of Germany's share size, followed by France and the U.K. The combined share of these countries came out to about X% of total exports in 2015. All of these countries reduced the volume of exports in 2015 compared with the previous year, with Germany showing a -X% decline, France and the UK with a -X% drop each, and Italy with -X%.

Since the share of extra-EU exports in the total EU paint and varnish output amounted to about X% in 2015, the EU paint and varnish industry is sensitive to the foreign markets conjuncture. Stable demand from the non-EU trade partners creates a strong support for the EU paint and varnish manufacturing industry. Extra-EU exports of paints and varnishes amounted to X million EUR in 2015, remaining constant with the previous year's value.

Russia, which held a stable X% share of total extra-exports of the EU over the past X years, was the main foreign market for EU Member States' exports of paints and varnishes, However, EU exports to Russia have noticeably declined in the past two years, influenced by the stagnation of construction and industrial production in Russia, combined with the increased cost of European products in the Russian market due to the growth of the Euro against the ruble.

Besides Russia, the largest shares of EU paint and varnish exports were held by Turkey (X% of extra-exports) and China (X%). Shipments to these countries grew in recent years, somewhat offsetting the decline in exports to Russia. Exports to Turkey increased by +X% per year over the period under review, while deliveries to China grew at a healthy average annual rate of +X%.

EU exports must be reallocated to countries in Asia in order to compensate for the decline in Russia's consumption. Despite the slowdown in the recent years, China's economy keeps expanding at a rapid rate, along with the ongoing urbanization process. This makes China a potentially promising market for EU paint and varnish industry.

Do you want to know more about the EU paint and varnish market? Get the latest trends and insight from our report. It includes a wide range of statistics on

- paint and varnish market share

- paint and varnish prices

- paint and varnish industry

- paint and varnish sales

- paint and varnish market forecast

- paint and varnish price forecast

- key paint and varnish producers

Source: EU: Paints And Varnishes - Market Report. Analysis And Forecast To 2020

This report provides an in-depth analysis of the paint and varnish market in the EU. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- Prodcom 20301150 - Paints and varnishes, based on acrylic or vinyl polymers dispersed or dissolved in an aqueous medium (including enamels and lacquers)

- Prodcom 20301170 - Other paints, varnishes dispersed or dissolved in an aqueous medium

- Prodcom 20301225 - Paints and varnishes, based on polyesters dispersed/dissolved in a non-aqueous medium, weight of the solvent > .50 % of the weight of the solution including enamels and lacquers

- Prodcom 20301229 - Paints and varnishes, based on polyesters dispersed/dissolved in a non-aqueous medium including enamels and lacquers excluding weight of the solvent > .50 % of the weight of the solution

- Prodcom 20301230 - Paints and varnishes, based on acrylic or vinyl polymers dispersed/dissolved in non-aqueous medium, weight of the solvent > .50 % of the solution weight including enamels and lacquers

- Prodcom 20301250 - Other paints and varnishes based on acrylic or vinyl polymers

- Prodcom 20301270 - Paints and varnishes: solutions n.e.c.

- Prodcom 20301290 - Other paints and varnishes based on synthetic polymers n.e.c.

- Prodcom 20302213 - Oil paints and varnishes (including enamels and lacquers)

- Prodcom 20302215 - Prepared water pigments for finishing leather, paints and varnishes (including enamels, lacquers and distempers) (excluding of oil)

Country coverage:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Production in the EU, split by region and country

- Trade (exports and imports) in the EU

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

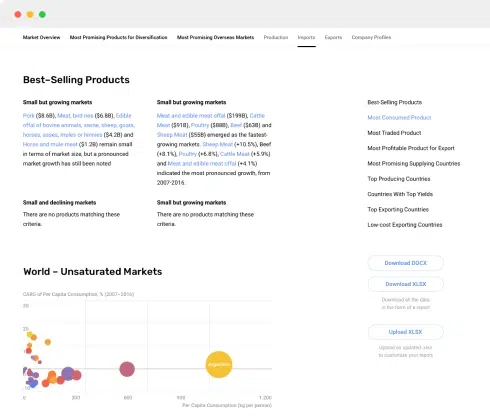

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

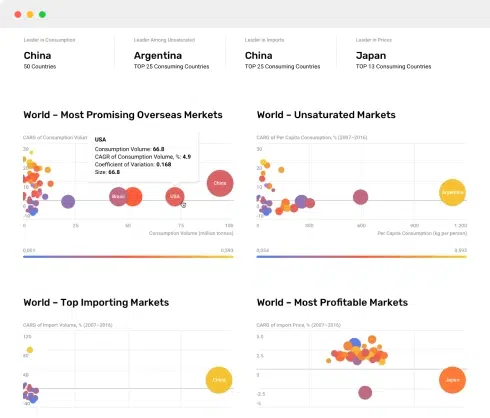

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023