EU - Tube Or Pipe Fittings (Of Iron Or Steel) - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingTube Fitting Market - Extra-EU Exports Become the Key Growth Driver of the EU Steel Tube Fittings Industry

Photo: © Rido81 / Bigstockphoto

EU-based industrial sector is currently experiencing a slow pace of growth; therefore the expansion prospects for the EU steel tube fittings industry largely depend on foreign market demand. Total EU exports of steel tube fittings have levelled out at X billion EUR, and attempts at establishing a post-crisis recovery since 2012 have not regained their momentum. The U.S., China, and Korea are the industry's fastest growing foreign markets; supplies to Korea have more than doubled in recent years.

The total EU Member States exports of steel tube fittings have languished over the last four years, amounting to X million EUR in 2015. Data regarding the EU trade with non-EU countries shows that the EU remains a net exporter of tube fittings.

Italy, Germany and, then the UK, somewhat behind, were the main suppliers on the EU steel tube fitting market, with a combined share of X% of total exports in 2015. Exports from Italy declined by -X% per year from 2007 to 2015, while Germany (+X% per year) and the UK (+X% per year) posted moderate gains. Therefore, Germany and the UK slightly strengthened their positions in terms of European exports, while Italy saw its share reduced.

The EU Member States engaged in the majority of the steel tube fittings trade. However, extra-EU exports accounted for about X% of the total in 2015. Extra-EU exports of tube fittings reached X million EUR that year, which was almost equal to the previous year's figure.

The EU steel tube fittings industry is largely export-orientated. Despite the fact that the industry's dependance on supplying foreign markets has been waned over the recent years, overall, the extra-EU exports share in terms of the total EU tube fittings output increased from X% in 2007 to about X% in 2015. A slowdown in exports has severely hampered growth prospects for the European manufacturers of steel tube fittings.

EU-manufactured steel tube fittings are largely obtainable worldwide. The U.S. (currently X% of extra-EU exports), for many years, was the main foreign market, with Norway, Switzerland, Saudi Arabia, China, Korea and Russia following close behind. Shipments to these countries have traditionally accounted for slightly more than X% of extra-EU exports.

The USA (+X per year), and China (+X per year), both represent a steadily expanding exports market. Exports to Switzerland are experiencing moderate growth, while other leading countries are seeing a downward trend. Korea is worth mentioning, in that imports of EU steel tube fittings have more than doubled over the past three years, thereby revealing new opportunities for European manufacturers.

Asia, along with the USA, is the world's most rapidly developing economy, where industry and the housing market continue to experience a recovery. The EU steel tube fittings industry, therefore, is expected to remain exports-orientated in the medium term, although moderate industrial growth within the EU would advance the domestic demand as well.

Do you want to know more about the EU tube or pipe fitting market? Get the latest trends and insight from our report. It includes a wide range of statistics on

- tube fitting market share

- tube fitting prices

- tube fitting industry

- tube fitting sales

- tube fitting market forecast

- tube fitting price forecast

- key tube fitting producers

Source: EU: Tube Or Pipe Fittings, Of Iron Or Steel - Market Report. Analysis And Forecast To 2020

Join Us at HANNOVER MESSE 2024

Don’t miss your chance to connect with us directly. Schedule a personal meeting to dive deeper into how solutions.

Hall 002, Stand C10. 22 - 26 April 2024 | Hannover, Germany

This report provides an in-depth analysis of the market for iron or steel tube fitting in the EU. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- Prodcom 24204010 - Flanges, of steel (excluding cast fittings)

- Prodcom 24204030 - Elbows, bends, couplings, sleeves and other threaded tube or pipe fittings, of steel (excluding cast fittings)

- Prodcom 24204050 - Elbows, bends, couplings and sleeves and other socket welding tube or pipe fittings, of steel (excluding cast fittings)

- Prodcom 24204073 - Butt welding elbows and bends, for tubes or pipes, of steel (excluding cast fittings)

- Prodcom 24204075 - Butt welding tube or pipe fittings, other than elbows and bends, of steel (excluding cast fittings)

- Prodcom 24513030 - Tube or pipe fittings, of non-malleable cast iron

- Prodcom 24513050 - Tube or pipe fittings of malleable cast iron

- Prodcom 24523000 - Tube or pipe fittings of cast steel

Country coverage:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Production in the EU, split by region and country

- Trade (exports and imports) in the EU

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

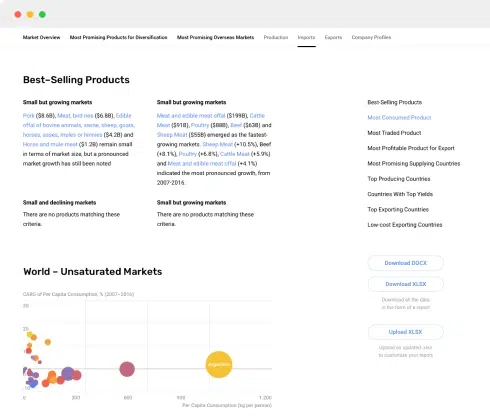

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

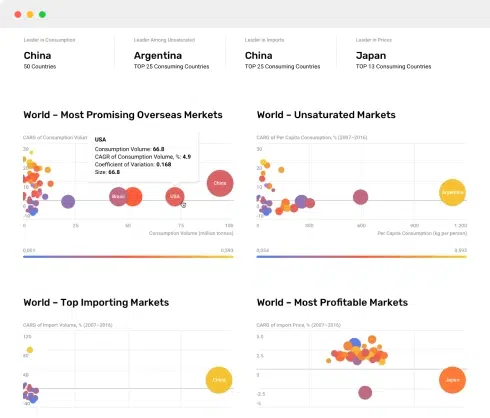

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023