World - Hazelnuts - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingHazelnut Market - Chile's and Argentina's Entry onto the Global Hazelnut Market will Ensure a Stable Supply

Photo: © De Visu / Bigstockphoto

Producers of confectionary products, wishing to reduce their dependency on Turkey's erratic and unstable hazelnut yield figures, are showing interest in the development of new areas and sites intended for hazelnut cultivation.

Global hazelnut output in 2015 surged by X%, reaching X tons, thereby emerging from the X% decline experienced in 2014. The favourable weather conditions in Turkey were a key factor in promoting this growth. Turkey is the world's leading producer of hazelnuts: last year, Turkey accounted for two thirds of the global hazelnut yield (X tons).

Despite being a popular snack product, hazelnuts are also a staple raw material for manufacturers of chocolate confectionary-based products and nut spread, such as Nutella, produced by the Ferrero Group, and which is also the most well-known brand: according to IndexBox estimates, the Ferrero Group's share accounts for X% of global hazelnut consumption.

Global hazelnut production is subject to tangible market fluctuations, despite the increased demand from the consumer sector: in 2009, output contracted by X% (to X tons), while in 2010, it increased by X% (to X tons) and then in 2011, it again declined by X% (to X tons). These swings can be explained by the yield output's reliance on the weather conditions in the key producer-countries, which, besides Turkey, include Italy and the USA - they account for X% and X% of global hazelnut production, respectively.

Strong fluctuations have been a standard dynamic of the global hazelnut market for the past two years. In 2014, Turkey's hazelnut yield in annual terms contracted by a quarter (to X tons). As a result of this, global consumption declined by X%, reaching X tons and average global prices surged by almost one and a half times - from $X thousand tons to $X thousand tons. In 2015, Turkey's hazelnut output increased by X%; as a result, global consumption surged by X% (to X tons), while the producers' average prices for hazelnuts declined by a quarter (to $X thousand tons).

Hazelnuts are being supplied to the global market mainly in their shelled form (i.e., kernels only, without the shell). According to IndexBox estimates, approx. X% of shelled hazelnut output was exported in 2015, amounting to X tons. In 2015, global shelled hazelnut consumption bounced back by X% to X tons, against a X% decline the previous year, due to the yield fluctuations. Please note, that estimated figures for shelled hazelnut consumption in terms of weight are significantly lower than production figures, as the kernel usually makes approx. a half of the whole nut weight.

Due to the stringent requirements regarding the quality and freshness of the raw hazelnut product, hazelnut processing manufacturers (Ferrero Group, for example, only procures hazelnuts in their shell) prefer to locate their production facilities as close as possible to the cultivation centres. Manufacturers of confectionary products prefer those countries with a climate similar to that of the Mediterranean; Chile, Australia, Argentina, New Zealand and the Republic of South Africa, therefore, appear to be promising prospects in terms of hazelnut cultivation.

In Chile, from 2007-2015, hazelnut production surged from X thousand to X thousand tons (in-shell hazelnut equivalent). This strong growth was made feasible, due to the increased amount of area being directed for hazelnut cultivation - from X ha. in 2000 to X ha. in 2015. Maule (X ha.) and Araucania (X ha.) are the key regions in Chile for the cultivation of hazelnuts; Bio-Bio is set to become a hazelnut producing region in the future. The Chilean authorities plan to increase the amount of acreage for hazelnut cultivation to X ha. in 2020, enabling the country to become the world's third largest hazelnut producer, with a total yield of X tons.

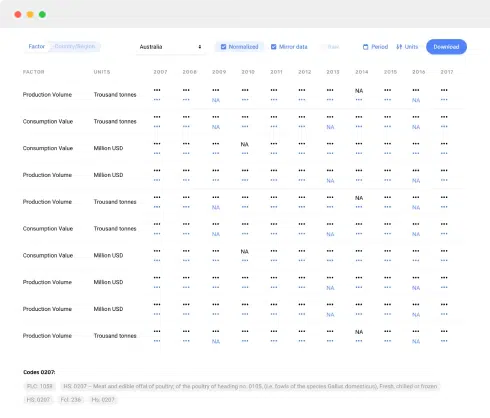

According to IndexBox estimates, Australia's hazelnut output currently stands at approx. X tons a year. However, due to the planting of young hazelnut trees in the states of New South Wales, Victoria and Tasmania, Australia will be capable of supplying hazelnuts on an industrial scale by 2020. In addition, unlike North American countries, the hazelnut trees in Australia are not susceptible to fungus, thereby minimising, or even erradicating, the need for pesticides.

IndexBox analysts conclude that the increased hazelnut output in Chile, Australia, Argentina, New Zealand and South Africa will encourage and promote the eradication of any inter-annual fluctuations in terms of hazelnut supply on the global market.

Do you want to know more about the global hazelnut market? Get the latest trends and insight from our report. It includes a wide range of statistics on

- hazelnut market share

- hazelnut prices

- hazelnut industry

- hazelnut sales

- hazelnut market forecast

- hazelnut price forecast

- key hazelnut producers

Source: World: Hazelnuts - Market Report. Analysis And Forecast To 2020

This report provides an in-depth analysis of the global hazelnut market. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- FCL 225 - Hazelnuts (Filberts)

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

Data coverage:

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

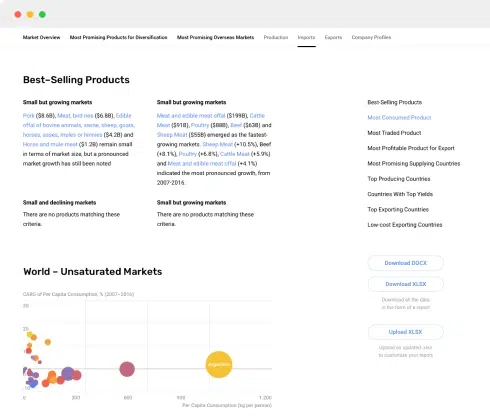

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- COUNTRIES WITH TOP YIELDS

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

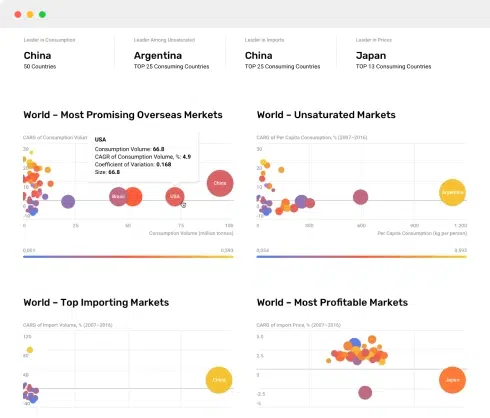

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

- HARVESTED AREA AND YIELD BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Harvested Area, By Country, 2012-2023

- Yield, By Country, 2012-2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Yield And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Area Harvested, 2012–2023

- Yield, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Harvested Area, By Country, 2023

- Harvested Area, By Country, 2012-2023

- Yield, By Country, 2012-2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023