Price for Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina - 2023

Contents:

- Price for Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina (CIF) - 2022

- Price for Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina (FOB) - 2022

- Imports of Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina

- Exports of Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina

Price for Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina (CIF) - 2022

In 2022, the average import price for seed; vegetable seed, of a kind used for sowings amounted to $121,150 per ton, increasing by 34% against the previous year. In general, import price indicated a resilient increase from 2012 to 2022: its price increased at an average annual rate of +5.0% over the last decade. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, import price for seed; vegetable seed, of a kind used for sowings increased by +78.1% against 2015 indices. As a result, import price reached the peak level and is likely to continue growth in the immediate term.

There were significant differences in the average prices amongst the major supplying countries. In 2022, amid the top importers, the country with the highest price was Chile ($174,829 per ton), while the price for Japan ($24,072 per ton) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by the United States (+7.7%), while the prices for the other major suppliers experienced more modest paces of growth.

Price for Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina (FOB) - 2022

The average export price for seed; vegetable seed, of a kind used for sowings stood at $52,968 per ton in 2022, declining by -3.5% against the previous year. Overall, export price indicated noticeable growth from 2012 to 2022: its price increased at an average annual rate of +2.3% over the last decade. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, export price for seed; vegetable seed, of a kind used for sowings decreased by -16.8% against 2018 indices. The pace of growth was the most pronounced in 2018 when the average export price increased by 53%. As a result, the export price attained the peak level of $63,693 per ton. From 2019 to 2022, the average export prices remained at a somewhat lower figure.

Average prices varied somewhat for the major external markets. In 2022, amid the top suppliers, the highest price was recorded for prices to Chile ($72,628 per ton) and Brazil ($59,093 per ton), while the average price for exports to the United States ($48,939 per ton) and the Netherlands ($52,633 per ton) were amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was recorded for supplies to Brazil (+11.4%), while the prices for the other major destinations experienced more modest paces of growth.

Imports of Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina

In 2022, overseas purchases of seed; vegetable seed, of a kind used for sowings decreased by -29.7% to 256 tons, falling for the second year in a row after two years of growth. Overall, imports showed a noticeable setback. The pace of growth appeared the most rapid in 2020 when imports increased by 29% against the previous year. As a result, imports reached the peak of 374 tons. From 2021 to 2022, the growth of imports of remained at a somewhat lower figure.

In value terms, imports of seed; vegetable seed, of a kind used for sowings shrank to $31M in 2022. The total import value increased at an average annual rate of +7.2% over the period from 2019 to 2022; however, the trend pattern remained relatively stable, with only minor fluctuations being recorded in certain years. The most prominent rate of growth was recorded in 2020 when imports increased by 25% against the previous year.

| Import of Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| China | 3.6 | 5.5 | 4.6 | 5.0 | 11.6% |

| United States | 4.6 | 5.3 | 4.5 | 3.9 | -5.4% |

| France | 1.2 | 1.5 | 1.7 | 2.5 | 27.7% |

| Chile | 1.2 | 2.8 | 2.8 | 2.2 | 22.4% |

| Brazil | 0.3 | 0.8 | 0.9 | 1.0 | 49.4% |

| Australia | 0.5 | 0.6 | 0.7 | 0.5 | 0.0% |

| Japan | 0.5 | 0.8 | 0.7 | 0.4 | -7.2% |

| New Zealand | 0.2 | 0.4 | 0.2 | 0.3 | 14.5% |

| Netherlands | 0.2 | 0.2 | 0.3 | 0.2 | 0.0% |

| South Africa | 0.2 | 0.2 | 0.2 | 0.2 | 0.0% |

| Others | 12.6 | 13.5 | 16.6 | 14.8 | 5.5% |

| Total | 25.2 | 31.5 | 33.1 | 31.0 | 7.1% |

Top Suppliers of Seed; Vegetable Seed, of A Kind Used for Sowing to Argentina in 2022:

- United States (88.7 tons)

- France (67.2 tons)

- China (29.4 tons)

- Japan (18.4 tons)

- Chile (12.6 tons)

- Brazil (8.1 tons)

- New Zealand (6.0 tons)

- Netherlands (4.6 tons)

- Australia (3.9 tons)

- South Africa (3.4 tons)

Exports of Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina

In 2022, shipments abroad of seed; vegetable seed, of a kind used for sowings was finally on the rise to reach 290 tons after two years of decline. In general, exports, however, recorded a relatively flat trend pattern.

In value terms, exports of seed; vegetable seed, of a kind used for sowings surged to $15M in 2022. Overall, exports showed a resilient expansion.

| Export of Seed; Vegetable Seed, of A Kind Used for Sowing in Argentina (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Netherlands | 4.1 | 6.4 | 4.4 | 6.5 | 16.6% |

| United States | 5.5 | 7.3 | 0.7 | 6.3 | 4.6% |

| Chile | 1.1 | 2.3 | N/A | 2.0 | 22.1% |

| Brazil | N/A | N/A | N/A | 0.4 | 0% |

| Japan | 1.1 | N/A | N/A | N/A | 0% |

| Others | 0.3 | 0.3 | N/A | 0.1 | -30.7% |

| Total | 12.1 | 16.4 | 5.1 | 15.4 | 8.4% |

Top Export Markets for Seed; Vegetable Seed, of A Kind Used for Sowing from Argentina in 2022:

- United States (129.6 tons)

- Netherlands (123.1 tons)

- Chile (27.0 tons)

- Brazil (7.4 tons)

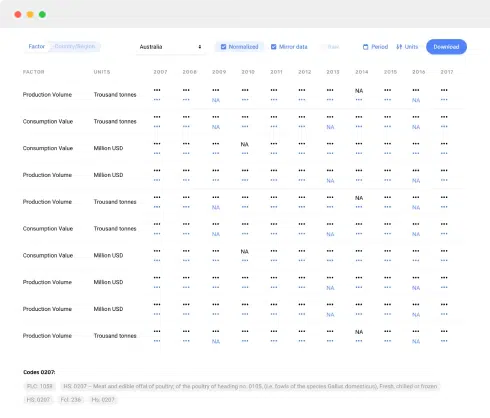

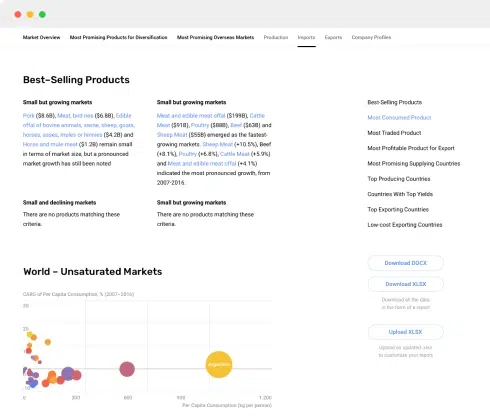

This report provides an in-depth analysis of the market for tree, flower and other seeds, fruits and spores for sowing in Argentina.

This report provides an in-depth analysis of the global market for tree, flower and other seeds, fruits and spores for sowing.

This report provides an in-depth analysis of the market for tree, flower and other seeds, fruits and spores for sowing in Argentina.

This report provides an in-depth analysis of the global market for tree, flower and other seeds, fruits and spores for sowing.

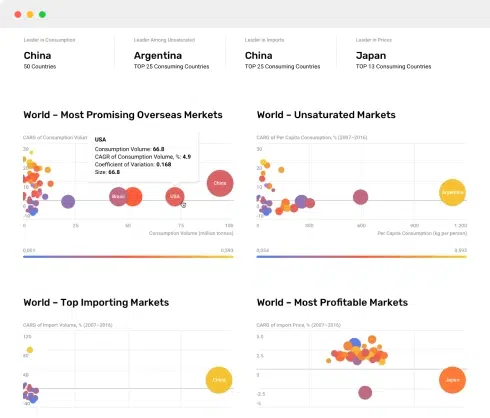

From 2007 to 2016, global palm kernel consumption displayed a mixed dynamic. As of the end of 2016, the global palm kernel market stood at X thousand tons or X million USD.

Global palm kernel consumption amounted to X thousand tons in 2015, growing by +X% against the previous year level.

In 2015, the countries with the highest levels of palm kernel production were Indonesia (X thousand tons), Malaysia (X thousand tons), Thailand (X thousand tons), together accounting for X% of total output.

In 2015, the countries with the highest levels of palm oil production were Indonesia (X thousand tons), Malaysia (X thousand tons), Thailand (X thousand tons), together accounting for X% of total output.

Indonesia dominates in the global palm kernel trade. In 2014, Indonesia exported X thousand tons of palm kernels totaling X million USD, X% over the previous year. Its primary trading partner was China, where it supplied X% of its total pal

From 2007 to 2016, global palm kernel consumption displayed a mixed dynamic. As of the end of 2016, the global palm kernel market stood at X thousand tons or X million USD.

Global palm kernel consumption amounted to X thousand tons in 2015, growing by +X% against the previous year level.

In 2015, the countries with the highest levels of palm kernel production were Indonesia (X thousand tons), Malaysia (X thousand tons), Thailand (X thousand tons), together accounting for X% of total output.

In 2015, the countries with the highest levels of palm oil production were Indonesia (X thousand tons), Malaysia (X thousand tons), Thailand (X thousand tons), together accounting for X% of total output.

Indonesia dominates in the global palm kernel trade. In 2014, Indonesia exported X thousand tons of palm kernels totaling X million USD, X% over the previous year. Its primary trading partner was China, where it supplied X% of its total pal