World - Tea - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingGreen Tea Industry

Green tea is one of the most popular beverages in the world, and its popularity is growing rapidly as more people become aware of the health benefits it offers. The global green tea industry has been expanding at a steady pace over the last few years, driven by factors such as increasing demand for natural and organic products, rising disposable incomes, and growing awareness of the health benefits of green tea.

Production of Green Tea

The global production of green tea has been on the rise over the last few years. China, Japan, and India are the leading producers of green tea, followed by Vietnam, Indonesia, and others. The global production of green tea is estimated to be over 3.6 million tons, and it is expected to grow at a CAGR of around 7% over the next few years.

Market Size of Green Tea Industry

The global green tea market size is estimated to be around USD 16 billion, and it is expected to grow at a CAGR of around 6% over the next few years. The Asia Pacific region is the largest market for green tea, followed by North America and Europe. The increasing demand for green tea products such as tea bags, loose-leaf tea, and ready-to-drink tea has been driving the growth of the green tea market.

Key Players in the Green Tea Industry

The global green tea market is highly fragmented, with a large number of players operating in the market. Some of the key players in the green tea industry include Unilever, Tata Global Beverages, Nestle S.A., Ito En Inc., Associated British Foods plc, Bigelow Tea Company, Celestial Seasonings, Inc., Dilmah Ceylon Tea Company PLC, The Republic of Tea, and Tenfu Group Co. Ltd.

Trends and Drivers of the Green Tea Industry

There are several trends and drivers that are contributing to the growth of the global green tea industry. One of the major drivers is the increasing awareness of the health benefits of green tea. Green tea is believed to have several health benefits, including reducing the risk of heart disease, lowering cholesterol levels, and improving brain function. As a result, more people are consuming green tea as part of their daily diet.

Another trend that is driving the growth of the green tea industry is the rising demand for natural and organic products. Consumers are increasingly looking for products that are free from harmful chemicals and artificial additives. Green tea is a natural product that is free from harmful chemicals, making it an attractive choice for health-conscious consumers.

The green tea industry is also being driven by the growing demand for herbal and specialty teas. Consumers are looking for new and unique flavors, and green tea is being used as a base for many specialty tea blends. This has led to an increase in the variety of green tea products available in the market.

Challenges Facing the Green Tea Industry

One of the major challenges facing the green tea industry is the competition from other beverages such as coffee and energy drinks. Consumers are increasingly turning to these products, and this has led to a decline in the consumption of tea, including green tea. The green tea industry is also facing challenges such as increased government regulations and fluctuating prices of green tea leaves.

Another challenge facing the green tea industry is the impact of climate change. Green tea requires a specific type of climate and soil conditions to grow, and any changes in these conditions can affect the quality and quantity of the tea produced. This can lead to a decrease in the supply of green tea and a rise in its prices.

Conclusion

The green tea industry is expected to continue growing in the coming years, driven by increasing demand for natural and organic products, rising disposable incomes, and growing awareness of the health benefits of green tea. However, the industry is also facing challenges such as competition from other beverages and the impact of climate change. Despite these challenges, the green tea industry is likely to remain a major player in the global beverage market, offering consumers a natural and healthy alternative to other beverages.

This report provides an in-depth analysis of the global tea market. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- FCL 667 - Tea

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

Data coverage:

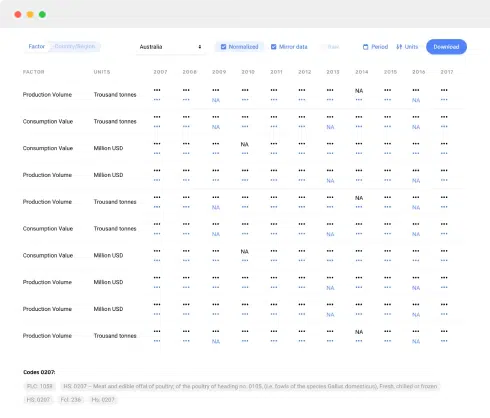

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Company coverage:

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

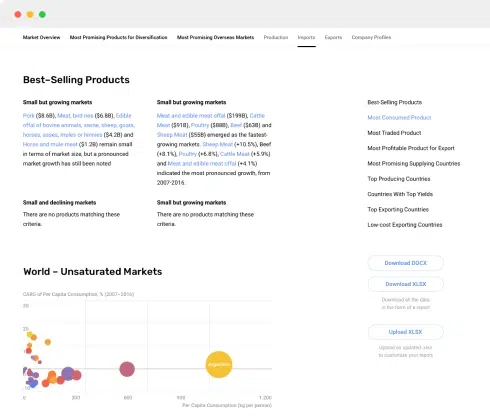

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- COUNTRIES WITH TOP YIELDS

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

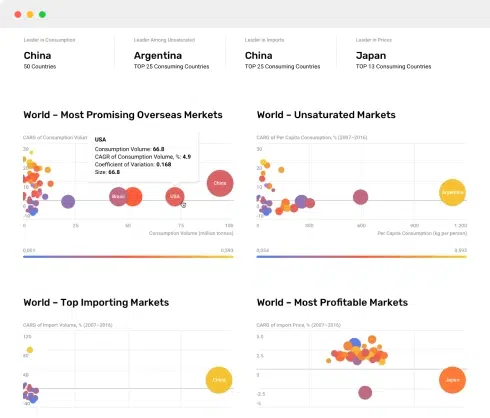

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

- HARVESTED AREA AND YIELD BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Harvested Area, By Country, 2012-2023

- Yield, By Country, 2012-2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Yield And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Area Harvested, 2012–2023

- Yield, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Harvested Area, By Country, 2023

- Harvested Area, By Country, 2012-2023

- Yield, By Country, 2012-2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023

Discover the top import markets for tea around the world based on data from the IndexBox market intelligence platform.

The tea market is growing rapidly, with new brands and products emerging all the time. But what trends are driving this growth?

The global tea market revenue amounted to $25.9B in 2018, picking up by 7.7% against the previous year. Overall, the total market indicated strong growth from 2007 to 2018: its value increased at an average annual rate of +4.3% over that period. Global

Global tea consumption amounted to X thousand tons in 2015, growing by +X% against the previous year level.

Global tea imports amounted to X thousand tons in 2015, declining by -X% against the previous year level.

From 2008 to 2015, global exports on the tea market showed mixed dynamics, amounting to X thousand tons in 2015. In value terms, they dropped to X million USD in 2015, which was X million USD less than the year before.

The global tea market showed an upward trend from 2008 to 2013 and reached a peak at X thousand tons. However, in 2014, dynamics downturned. During the next two years, the global tea market decreased to X thousand tons.

The volume of total imports on the global tea market in 2015 stood at X thousand tons. In value terms, imports of tea decreased to X million USD in 2015, which was X million USD (X%) less than the year before.

From 2008 to 2013, global tea market production showed steady growth, reaching its peak level at X thousand tons. It was followed by a slight shrinkage over the next two years to X thousand tons in 2015.

Cost-effective labour, plenty of market opportunities and increasing demand from importers are all factors that are making the African tea industry appear an attractive prospect for investors on global tea market. However, political instability and poo