World - Motorcycles, Scooters and Side-Cars - Market Analysis, Forecast, Size, Trends And Insights

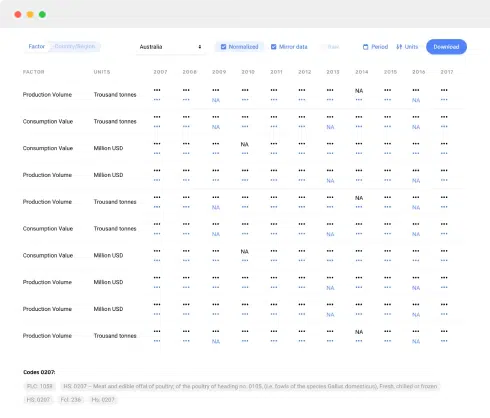

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingMotorcycle, Scooter and Side-Car Market

The article provides a comprehensive overview of the global motorcycle, scooter, and side-car market, projecting an anticipated CAGR of +2.9% in consumption and +2.7% in market value from 2022 to 2030. Key insights include market volumes, values, consumption and production trends, as well as import and export statistics for major countries. The analysis covers a decade from 2012 to 2022, highlighting fluctuations and growth rates across different product types and geographical regions. From leading consuming countries to top producers and exporters, the article offers a detailed examination of the market dynamics and trends in the motorcycle industry.

Market Forecast

Driven by increasing demand for motorcycles, scooters and side-cars worldwide, the market is expected to continue an upward consumption trend over the next eight-year period. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +2.9% for the period from 2022 to 2030, which is projected to bring the market volume to 157M units by the end of 2030.

In value terms, the market is forecast to increase with an anticipated CAGR of +2.7% for the period from 2022 to 2030, which is projected to bring the market value to $168.8B (in nominal prices) by the end of 2030.

Consumption

World Consumption of Motorcycles, Scooters and Side-Cars

Global motorcycle, scooter and side-car consumption stood at 125M units in 2022, surging by 5.8% on the previous year. In general, the total consumption indicated a buoyant expansion from 2012 to 2022: its volume increased at an average annual rate of +5.4% over the last decade. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, consumption increased by +76.8% against 2013 indices. Over the period under review, global consumption hit record highs in 2022 and is likely to continue growth in the immediate term.

The global motorcycle, scooter and side-car market value amounted to $136.1B in 2022, remaining relatively unchanged against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers' margins, which will be included in the final consumer price). The market value increased at an average annual rate of +3.9% from 2012 to 2022; however, the trend pattern indicated some noticeable fluctuations being recorded throughout the analyzed period. Global consumption peaked at $137.4B in 2017; however, from 2018 to 2022, consumption remained at a lower figure.

Consumption By Country

The countries with the highest volumes of consumption in 2022 were China (39M units), India (26M units) and Pakistan (10M units), together accounting for 60% of global consumption. The United States, the Philippines, Vietnam and Germany lagged somewhat behind, together comprising a further 13%.

From 2012 to 2022, the most notable rate of growth in terms of consumption, amongst the leading consuming countries, was attained by Germany (with a CAGR of +17.8%), while consumption for the other global leaders experienced more modest paces of growth.

In value terms, the largest motorcycle, scooter and side-car markets worldwide were China ($20.4B), India ($18.5B) and the United States ($7B), with a combined 34% share of the global market. Vietnam, Germany, the Philippines and Pakistan lagged somewhat behind, together comprising a further 12%.

The Philippines, with a CAGR of +17.6%, saw the highest growth rate of market size in terms of the main consuming countries over the period under review, while market for the other global leaders experienced more modest paces of growth.

The countries with the highest levels of motorcycle, scooter and side-car per capita consumption in 2022 were Pakistan (46 units per 1000 persons), the Philippines (44 units per 1000 persons) and Germany (35 units per 1000 persons).

From 2012 to 2022, the most notable rate of growth in terms of consumption, amongst the leading consuming countries, was attained by Germany (with a CAGR of +17.3%), while consumption for the other global leaders experienced more modest paces of growth.

Consumption By Type

The products with the highest volumes of consumption in 2022 were motorcycles and scooters (69M units) and side cars and cycles with non-combustion motors (55M units).

From 2012 to 2022, the biggest increases were recorded for side cars and cycles with non-combustion motors (with a CAGR of +9.6%).

In value terms, motorcycles and scooters ($77B) led the market, alone. The second position in the ranking was taken by side cars and cycles with non-combustion motors ($35.1B).

For motorcycles and scooters, market expanded at an average annual rate of +2.5% over the period from 2012-2022.

Production

World Production of Motorcycles, Scooters and Side-Cars

In 2022, approx. 126M units of motorcycles, scooters and side-cars were produced worldwide; with an increase of 4.1% against the year before. Over the period under review, the total production indicated a remarkable increase from 2012 to 2022: its volume increased at an average annual rate of +5.9% over the last decade. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, production decreased by -1.8% against 2020 indices. The pace of growth appeared the most rapid in 2018 with an increase of 25% against the previous year. Global production peaked at 128M units in 2020; however, from 2021 to 2022, production remained at a lower figure.

In value terms, motorcycle, scooter and side-car production stood at $109.2B in 2022 estimated in export price. In general, the total production indicated a noticeable increase from 2012 to 2022: its value increased at an average annual rate of +4.1% over the last decade. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, production decreased by -1.3% against 2020 indices. The pace of growth was the most pronounced in 2015 when the production volume increased by 36%. Over the period under review, global production attained the maximum level at $127.1B in 2017; however, from 2018 to 2022, production stood at a somewhat lower figure.

Production By Country

The country with the largest volume of motorcycle, scooter and side-car production was China (64M units), comprising approx. 51% of total volume. Moreover, motorcycle, scooter and side-car production in China exceeded the figures recorded by the second-largest producer, India (29M units), twofold. The third position in this ranking was taken by Vietnam (4.4M units), with a 3.5% share.

From 2012 to 2022, the average annual growth rate of volume in China amounted to +3.7%. The remaining producing countries recorded the following average annual rates of production growth: India (+9.3% per year) and Vietnam (+1.8% per year).

Production By Type

The products with the highest volumes of production in 2022 were motorcycles and scooters (67M units) and side cars and cycles with non-combustion motors (58M units).

From 2012 to 2022, the most notable rate of growth in terms of production, amongst the leading produced products, was attained by side cars and cycles with non-combustion motors (with a CAGR of +11.0%).

In value terms, motorcycles and scooters ($73.4B) led the market, alone. The second position in the ranking was held by side cars and cycles with non-combustion motors ($36.5B).

For motorcycles and scooters, production expanded at an average annual rate of +1.7% over the period from 2012-2022.

Imports

World Imports of Motorcycles, Scooters and Side-Cars

In 2022, after two years of growth, there was significant decline in overseas purchases of motorcycles, scooters and side-cars, when their volume decreased by -9.6% to 42M units. Over the period under review, imports, however, posted strong growth. The most prominent rate of growth was recorded in 2021 with an increase of 34%. As a result, imports attained the peak of 46M units, and then reduced in the following year.

In value terms, motorcycle, scooter and side-car imports totaled $37.5B in 2022. Overall, imports, however, continue to indicate a prominent increase. The pace of growth appeared the most rapid in 2021 with an increase of 29%. Global imports peaked in 2022 and are likely to see gradual growth in the near future.

Imports By Country

The countries with the highest levels of motorcycle, scooter and side-car imports in 2022 were Pakistan (6.4M units), the United States (5.3M units), the Philippines (4.9M units) and the Netherlands (3.6M units), together finishing at 48% of total import. It was distantly followed by Germany (2.3M units), achieving a 5.5% share of total imports. France (1,374K units), the UK (1,068K units), Belgium (987K units), Japan (841K units), Spain (787K units), Canada (730K units) and Italy (706K units) followed a long way behind the leaders.

From 2012 to 2022, the most notable rate of growth in terms of purchases, amongst the key importing countries, was attained by the Netherlands (with a CAGR of +32.1%), while imports for the other global leaders experienced more modest paces of growth.

In value terms, the largest motorcycle, scooter and side-car importing markets worldwide were the United States ($4.9B), Germany ($3.4B) and France ($2.1B), together comprising 27% of global imports. The Philippines, the Netherlands, Belgium, Italy, Spain, the UK, Canada, Japan and Pakistan lagged somewhat behind, together accounting for a further 30%.

The Philippines, with a CAGR of +22.5%, saw the highest growth rate of the value of imports, among the main importing countries over the period under review, while purchases for the other global leaders experienced more modest paces of growth.

Imports By Type

In 2022, side cars and cycles with non-combustion motors (22M units), distantly followed by motorcycles and scooters (19M units) were the major types of motorcycles, scooters and side-cars, together mixing up 100% of total imports.

From 2012 to 2022, the most notable rate of growth in terms of purchases, amongst the leading imported products, was attained by side cars and cycles with non-combustion motors (with a CAGR of +21.5%).

In value terms, the largest types of imported motorcycles, scooters and side-cars were motorcycles and scooters ($24.1B) and side cars and cycles with non-combustion motors ($13.4B).

Side cars and cycles with non-combustion motors , with a CAGR of +28.6%, recorded the highest rates of growth with regard to the value of imports, in terms of the main imported products over the period under review.

Import Prices By Type

In 2022, the average motorcycle, scooter and side-car import price amounted to $897 per unit, jumping by 16% against the previous year. Overall, the import price, however, saw a mild shrinkage. The most prominent rate of growth was recorded in 2019 an increase of 17% against the previous year. Over the period under review, average import prices attained the peak figure at $1,037 per unit in 2014; however, from 2015 to 2022, import prices failed to regain momentum.

Prices varied noticeably by the product type; the product with the highest price was motorcycles and scooters ($1,242 per unit), while the price for side cars and cycles with non-combustion motors stood at $597 per unit.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by side car and cycle with non-combustion motor (+5.8%).

Import Prices By Country

In 2022, the average motorcycle, scooter and side-car import price amounted to $897 per unit, surging by 16% against the previous year. In general, the import price, however, saw a slight shrinkage. The pace of growth appeared the most rapid in 2019 an increase of 17%. Over the period under review, average import prices hit record highs at $1,037 per unit in 2014; however, from 2015 to 2022, import prices failed to regain momentum.

Prices varied noticeably by country of destination: amid the top importers, the country with the highest price was Italy ($2,183 per unit), while Pakistan ($10 per unit) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by the Philippines (+11.0%), while the other global leaders experienced a decline in the import price figures.

Exports

World Exports of Motorcycles, Scooters and Side-Cars

After five years of growth, overseas shipments of motorcycles, scooters and side-cars decreased by -12.8% to 43M units in 2022. In general, exports, however, continue to indicate a remarkable increase. The pace of growth appeared the most rapid in 2018 with an increase of 105% against the previous year. The global exports peaked at 49M units in 2021, and then contracted in the following year.

In value terms, motorcycle, scooter and side-car exports rose slightly to $42.3B in 2022. Over the period under review, exports, however, posted a prominent expansion. The most prominent rate of growth was recorded in 2021 when exports increased by 32% against the previous year. The global exports peaked in 2022 and are likely to see steady growth in years to come.

Exports By Country

China prevails in exports structure, finishing at 26M units, which was near 60% of total exports in 2022. India (3.6M units) ranks second in terms of the total exports with an 8.4% share, followed by the Netherlands (5.9%). Vietnam (1,405K units), Taiwan (Chinese) (1,106K units), Germany (961K units), Italy (702K units) and Thailand (691K units) followed a long way behind the leaders.

Exports from China increased at an average annual rate of +10.3% from 2012 to 2022. At the same time, the Netherlands (+41.1%), Vietnam (+31.0%), Germany (+18.1%), Italy (+10.7%), Taiwan (Chinese) (+9.8%), India (+6.7%) and Thailand (+3.6%) displayed positive paces of growth. Moreover, the Netherlands emerged as the fastest-growing exporter exported in the world, with a CAGR of +41.1% from 2012-2022. From 2012 to 2022, the share of the Netherlands and Vietnam increased by +5.4 and +2.6 percentage points, respectively. The shares of the other countries remained relatively stable throughout the analyzed period.

In value terms, China ($11.5B) remains the largest motorcycle, scooter and side-car supplier worldwide, comprising 27% of global exports. The second position in the ranking was taken by Germany ($3.4B), with an 8% share of global exports. It was followed by Thailand, with a 7% share.

In China, motorcycle, scooter and side-car exports increased at an average annual rate of +9.1% over the period from 2012-2022. In the other countries, the average annual rates were as follows: Germany (+10.4% per year) and Thailand (+10.0% per year).

Exports By Type

Side cars and cycles with non-combustion motors represented the main type of motorcycles, scooters and side-cars in the world, with the volume of exports reaching 26M units, which was near 60% of total exports in 2022. It was distantly followed by motorcycles and scooters (17M units), making up a 40% share of total exports.

From 2012 to 2022, the most notable rate of growth in terms of shipments, amongst the main exported products, was attained by side cars and cycles with non-combustion motors (with a CAGR of +30.8%).

In value terms, the largest types of exported motorcycles, scooters and side-cars were motorcycles and scooters ($27.1B) and side cars and cycles with non-combustion motors ($15.2B).

In terms of the main exported products, side cars and cycles with non-combustion motors , with a CAGR of +30.5%, saw the highest growth rate of the value of exports, over the period under review.

Export Prices By Type

The average motorcycle, scooter and side-car export price stood at $990 per unit in 2022, surging by 20% against the previous year. Over the period under review, the export price, however, saw a pronounced contraction. The most prominent rate of growth was recorded in 2015 when the average export price increased by 29%. Over the period under review, the average export prices hit record highs at $1,755 per unit in 2016; however, from 2017 to 2022, the export prices remained at a lower figure.

Prices varied noticeably by the product type; the product with the highest price was motorcycles and scooters ($1,586 per unit), while the average price for exports of side cars and cycles with non-combustion motors stood at $593 per unit.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by motorcycle and scooter (+1.7%).

Export Prices By Country

In 2022, the average motorcycle, scooter and side-car export price amounted to $990 per unit, growing by 20% against the previous year. Over the period under review, the export price, however, showed a pronounced descent. The most prominent rate of growth was recorded in 2015 when the average export price increased by 29%. The global export price peaked at $1,755 per unit in 2016; however, from 2017 to 2022, the export prices failed to regain momentum.

There were significant differences in the average prices amongst the major exporting countries. In 2022, amid the top suppliers, the country with the highest price was Thailand ($4,285 per unit), while China ($451 per unit) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by Thailand (+6.2%), while the other global leaders experienced more modest paces of growth.

This report provides an in-depth analysis of the global market for motorcycle, scooter and side-car. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- Prodcom 30911200 - Motorcycles with reciprocating internal combustion piston engine > .50 cm.

- Prodcom 30911300 - Side cars for motorcycles, cycles with auxiliary motors other than reciprocating internal combustion piston engine

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

Data coverage:

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

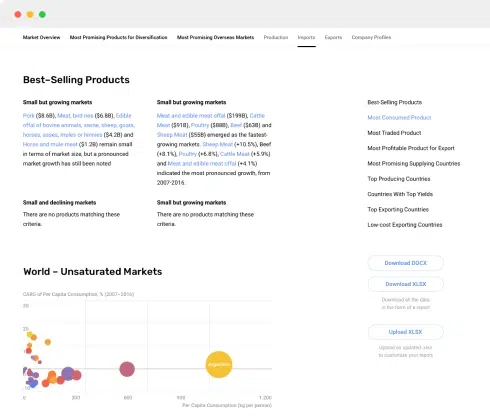

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

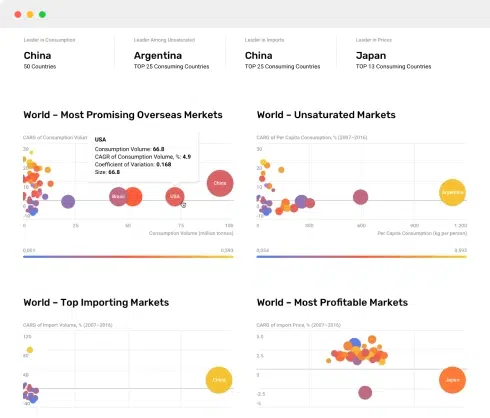

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023

This report provides an in-depth analysis of the global market for motorcycle, scooter and side-car.

This report provides an in-depth analysis of the global market for side car and cycle with non-combustion motor.

This report provides an in-depth analysis of the global motorcycle and scooter market.

This report provides an in-depth analysis of the global market for motorcycles and cycles with an auxiliary motor.

This report provides an in-depth analysis of the global motorcycle and bicycle market.

This report provides an in-depth analysis of the global market for electric motorcycles, scooters and cycles.

Explore the world's best import markets for motorcycles, scooters, and side-cars. Discover the top countries with high import values, including the United States, Germany, France, and more.

In 2016, approx. X tons of motorcycle and scooter were imported worldwide- coming up by X% against the previous year level. In general, motorcycle and scooter imports continue to indicate a relat...

In 2016, approx. X tons of motorcycle and scooter were imported worldwide- coming up by X% against the previous year level. In general, motorcycle and scooter imports continue to indicate a relat...

From 2007 to 2014, the global motorcycle and scooter market showed mixed dynamics. A slight decrease in 2009 (-X% Y-o-Y) was followed by a X% increase in 2010. Over the next three years, the market gradually increased to X million units. In value te

A lower costs policy coupled with the launching of new products is expected to double the Japanese Yamaha Motor Co.'s motorcycle profit margin by 2018. According to the Japan Times, Yamaha aims to increase their overall margin to X% by 2018. Hiroyuki

Discover the top import markets for side cars and cycles with non-combustion motors based on the latest statistics from IndexBox. Explore the import values and key statistics of these markets in 2022.

In recent years, the global demand for motorcycles and scooters has been steadily increasing. These vehicles offer an affordable and convenient mode of transportation, making them popular in both developed and developing countries. In this article, we will explore the top import markets for motorcycles and scooters and provide key statistics.

Explore the top import markets for motorcycles and bicycles and uncover the potential opportunities in these countries. Learn about market statistics, key import values, and growth drivers.